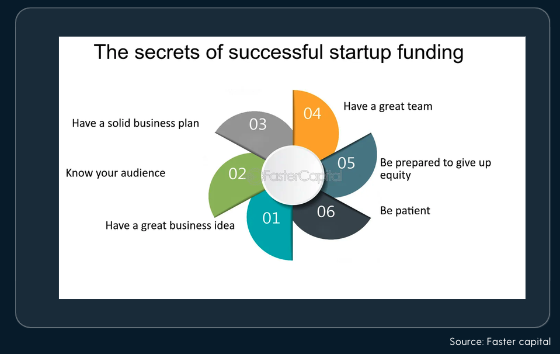

Pitch Perfect: Mastering the Art of Startup Fundraising

One of the critical factors that can make or break a startup’s success is funding. Securing adequate financial resources is often a fundamental challenge for early-stage ventures, as they navigate the path from idea to market. Startup funding plays a pivotal role in fueling innovation, supporting growth, and enabling entrepreneurs to bring their visions to life. In this insightful blog, we delve into the world of startup funding, exploring the various sources, strategies, and considerations that entrepreneurs must navigate to secure the necessary capital for their ventures.

Startup funding is the financial fuel that gets your new business off the ground and helps it grow. It comes in various forms, from your own savings (bootstrapping) to investments from angel investors or venture capitalists, to crowdfunding campaigns and even government grants.

Turning a startup idea into reality requires more than just a brilliant concept and a dedicated team. It demands financial resources to fuel growth, develop prototypes, hire talent, and penetrate the market. This is where startup funding becomes crucial. Whether you are an aspiring entrepreneur or an established founder looking to scale your business, understanding the intricacies of startup funding is essential. From bootstrapping and angel investors to venture capital and crowdfunding, the avenues to secure funding are diverse and ever-evolving.

Pros

- Faster Growth

- Expertise and Network

- Validation

- Reduced Risk

Cons

- Loss of Control

- Pressure for Growth

- Debt Burden

- Ownership Dilution

Bootstrapping

Bootstrapping is the quintessential method of self-reliance. It involves utilizing personal savings, credit cards, or even tapping into your network for loans to finance your startup. This approach offers complete control over your business, but it also limits your initial growth potential.

CROWDFUNDING

Crowdfunding platforms allow you to raise capital from a large pool of individuals, often through online portals. This method offers wider reach and can help validate your concept through pre-orders or sales. However, crowdfunding campaigns require meticulous planning and effective marketing strategies.

ANGEL INVESTORS

Angel investors are often high-net-worth individuals who invest their personal wealth in promising startups. They are drawn to innovative ideas and passionate founders, and they can provide valuable mentorship alongside their financial backing. However, convincing angels to invest requires a compelling pitch and a clear vision for your company’s future.

VENTURE CAPITALISTS

Venture capitalists (VCs) are firms that raise capital from institutions and high-net-worth individuals to invest in startups with high growth potential. Unlike angel investors, VCs typically invest larger sums of money but expect significant equity stakes and a faster return on their investment. Securing VC funding validates your concept but comes with the pressure to deliver exponential growth.

Government Grants

Government agencies often offer grants to startups working in specific sectors or addressing social challenges. Winning a grant can significantly boost your initial funding, but the application process can be competitive, and the grant terms might restrict how you use the funds.