Neobanks and Financial Inclusion: Bridging the Banking Gap

As technology continues to reshape our daily lives, a new breed of financial institutions has emerged, poised to revolutionize traditional banking as we know it.

Neobanks are transforming the way we engage with our money.

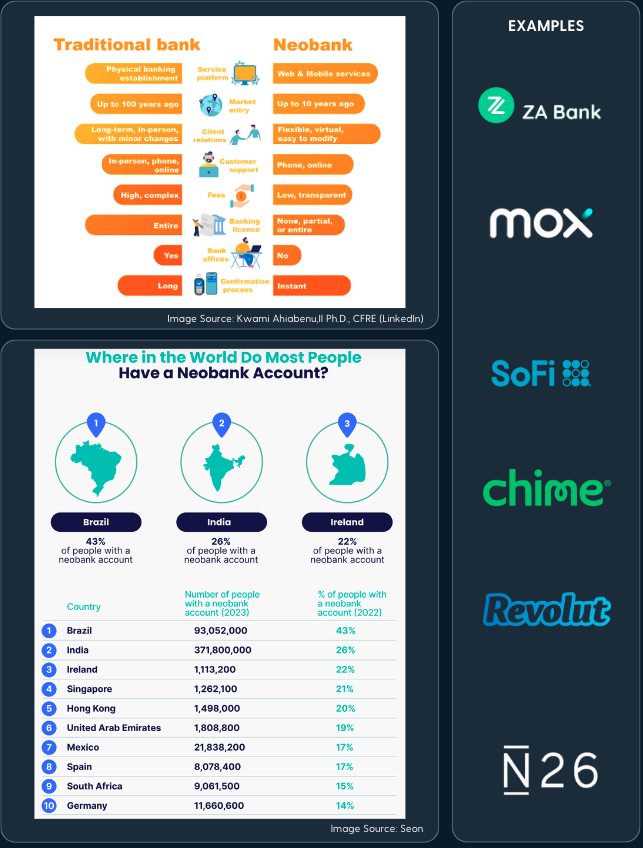

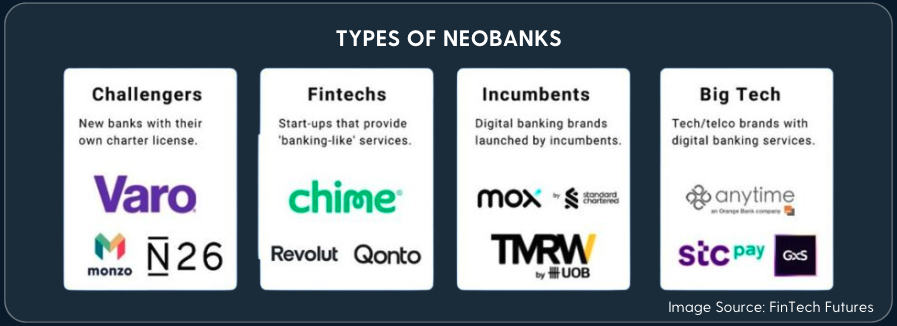

These digital banks (or challenger banks) operate exclusively online, providing banking services through mobile apps or web platforms. They offer utilities such as everyday banking services, budgeting and financial management, international payments, digital wallet integration, and access for underserved populations. Unlike traditional brick-and-mortar banks, neobanks don’t have physical branches, they gained significant traction in recent years, attracting customers who appreciate the convenience, user-friendly interfaces, and innovative features they offer.

With their customer-centric approach, innovative features, and seamless user experiences, neobanks are rewriting the rules and empowering individuals and businesses to take control of their financial lives like never before. In just a few taps on your smartphone, you can effortlessly unlock a world of financial possibilities, open an account, manage funds, and make transactions.

Neobanks are pioneers of financial inclusion, bridging the gap for individuals and businesses left underserved by traditional banking systems. Freelancers, entrepreneurs, and digital nomads find solace in neobanks, as these institutions cater to their unique needs without prejudice. Neobanks embrace diversity, offering accessible and inclusive financial services to all, regardless of their financial status or background.

Security is of paramount importance in the realm of finance, and neobanks are acutely aware of this responsibility. Equipped with cutting-edge encryption, robust security measures, and stringent authentication protocols, neobanks ensure that your money and personal information remain protected at all times. They foster an environment of trust and transparency, providing you with the peace of mind necessary to navigate the digital financial landscape.

Pros

- Quick Account Setup

- Convenience: 24/7 access

- Lower Fees

- Innovative Features: Real-time transaction notifications, automated savings tools, spending categorization, and instant person-to-person payments.

- Complementary Partnerships: e.g. budgeting apps, investment platforms, and digital wallets.

- Focus on Personalization: Leverage data analytics and AI based on their spending patterns and financial goals

- Regulation Frameworks are evolving to encourage innovation

Cons

- Limited Physical Presence

- Reliance on Technology (stable internet connectivity)

- Security Concerns: However, reputable neobanks have employed robust security measures, encryption techniques, and fraud detection systems.

- Restricted Offerings: May not provide the full range of financial products and services offered by traditional banks, could be a limitation for customers with more specialized or complex financial needs.

- Trust and Familiarity